A Limited Partnership

Liberian Limited Partnerships Global Money Consultants

Solved In A Limited Partnership The Liability Of A Limit Chegg Com

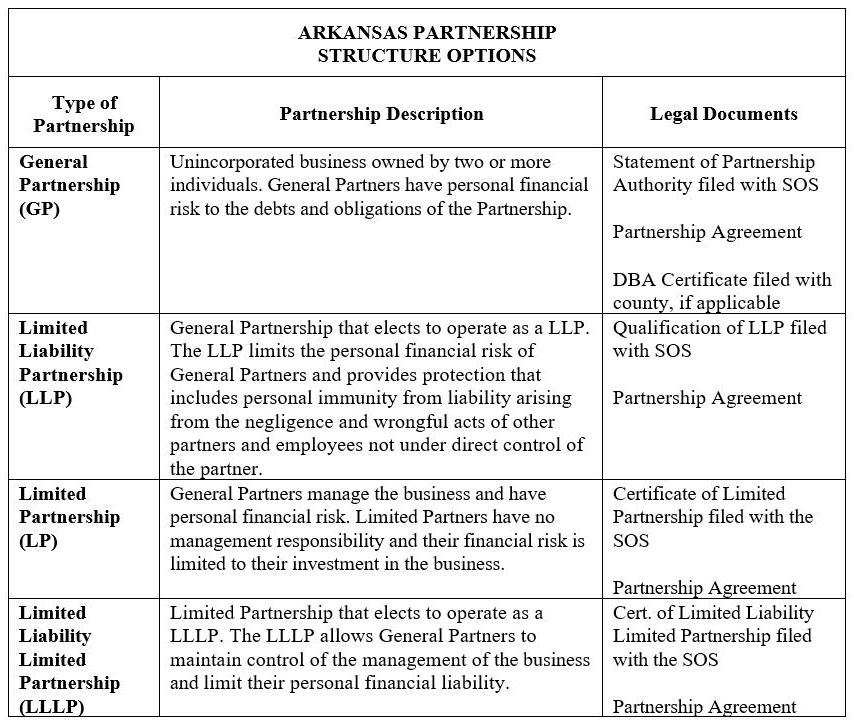

Opening New Accounts Why So Many Different Types Of Partnerships

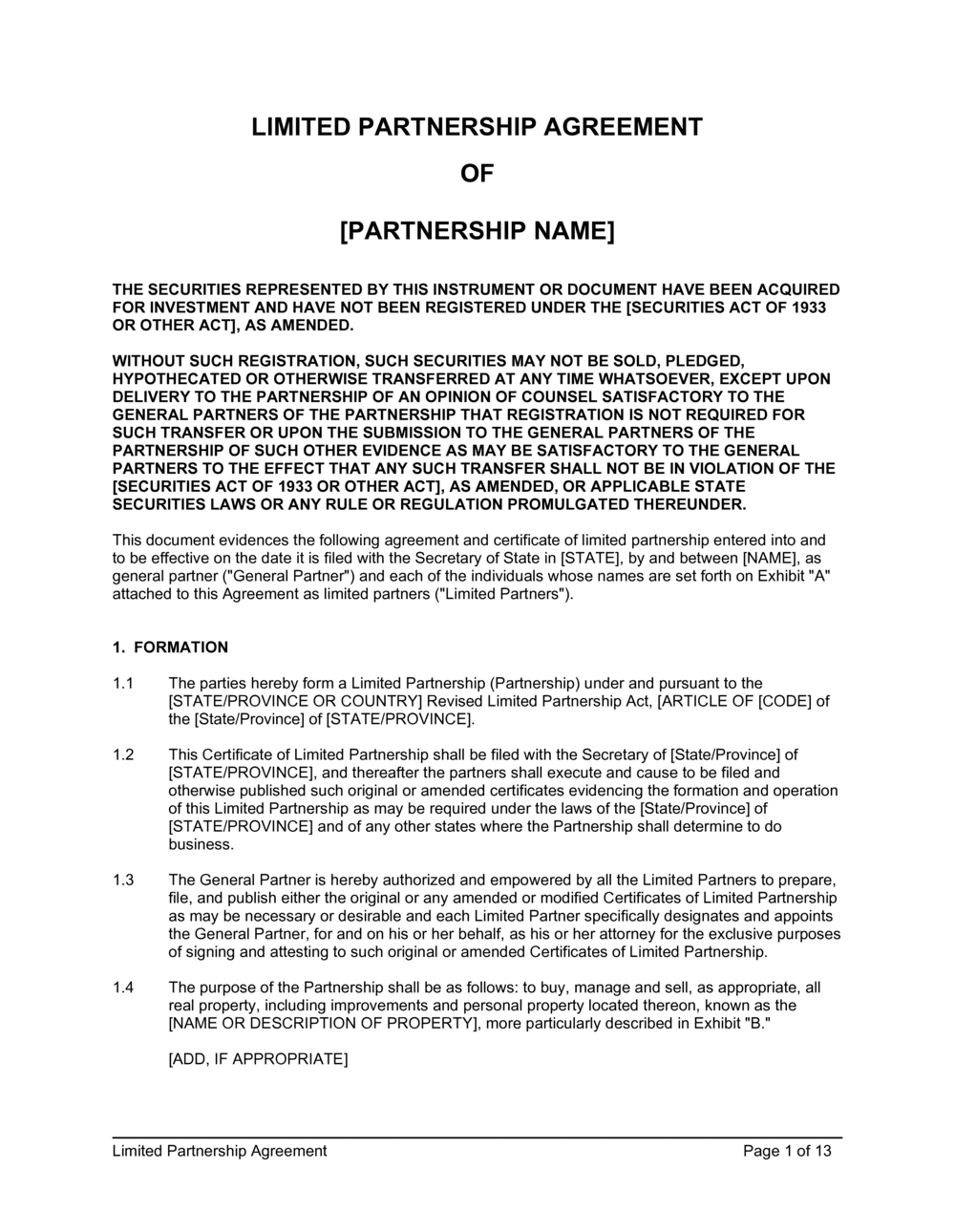

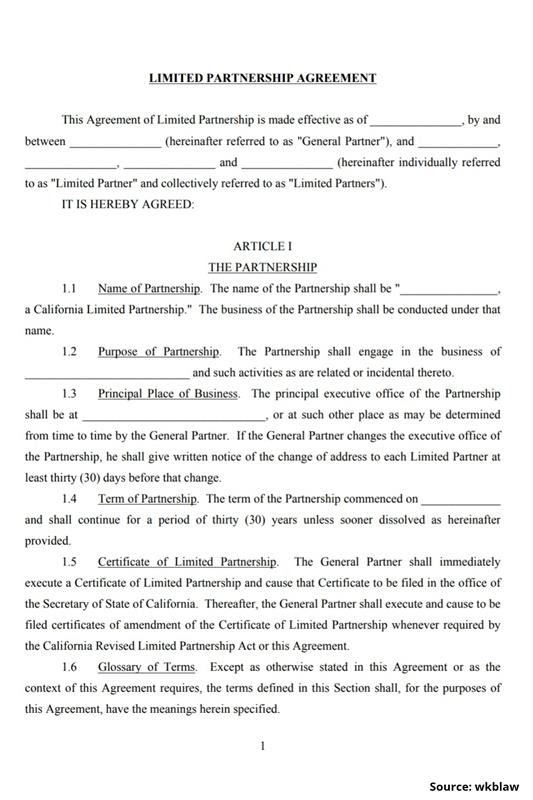

Limited Partnership Agreement Pros Cons And Sample Template

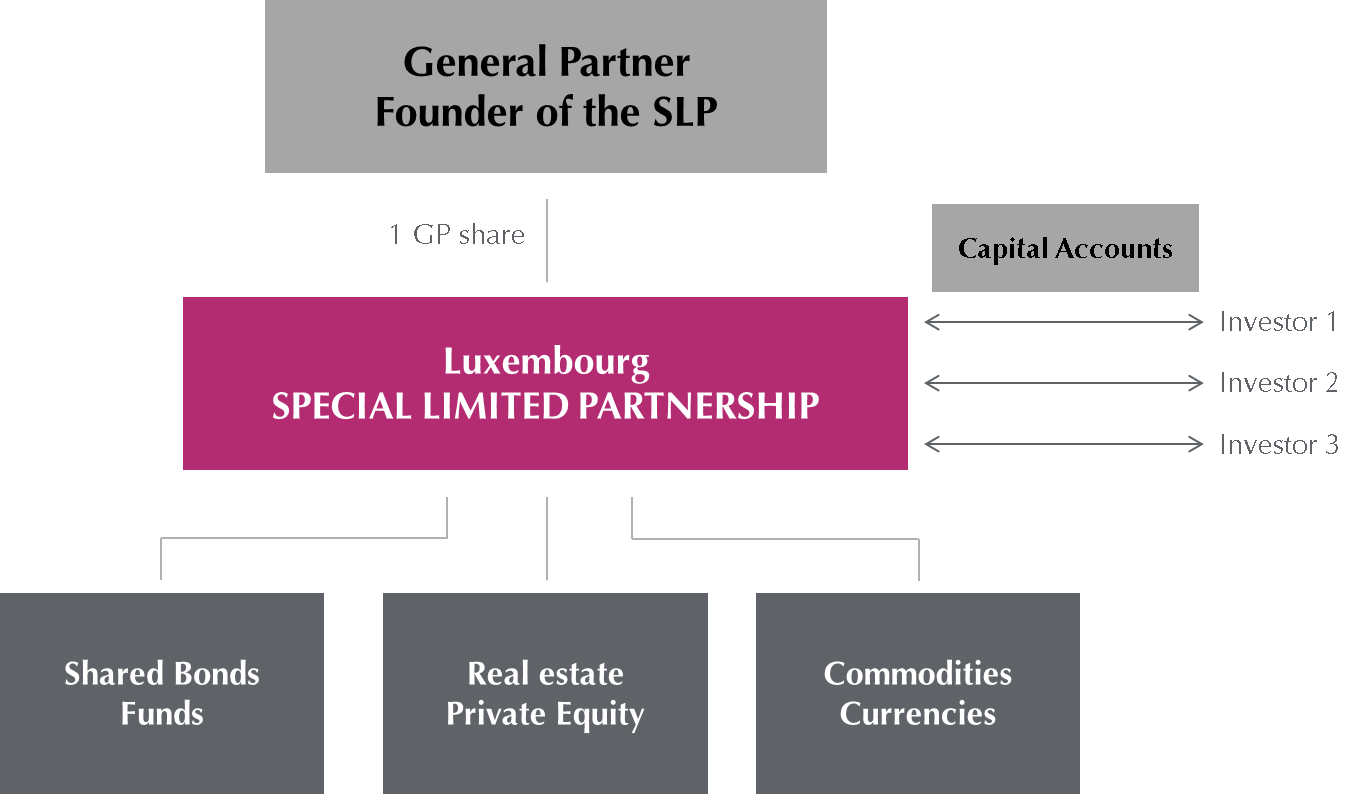

Special Limited Partnership Capital Account

Limited Partnership What Is It How To Form One Fundera

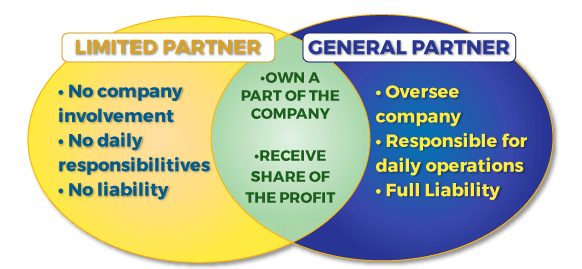

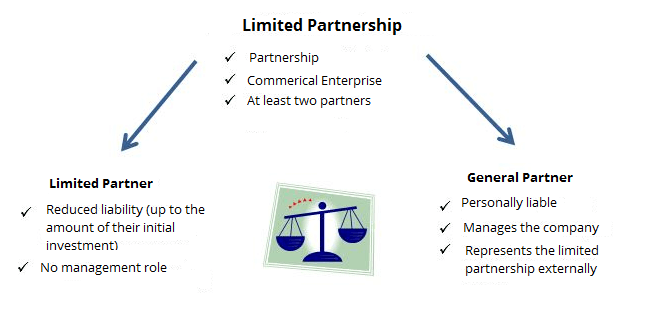

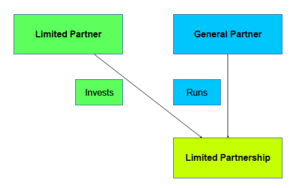

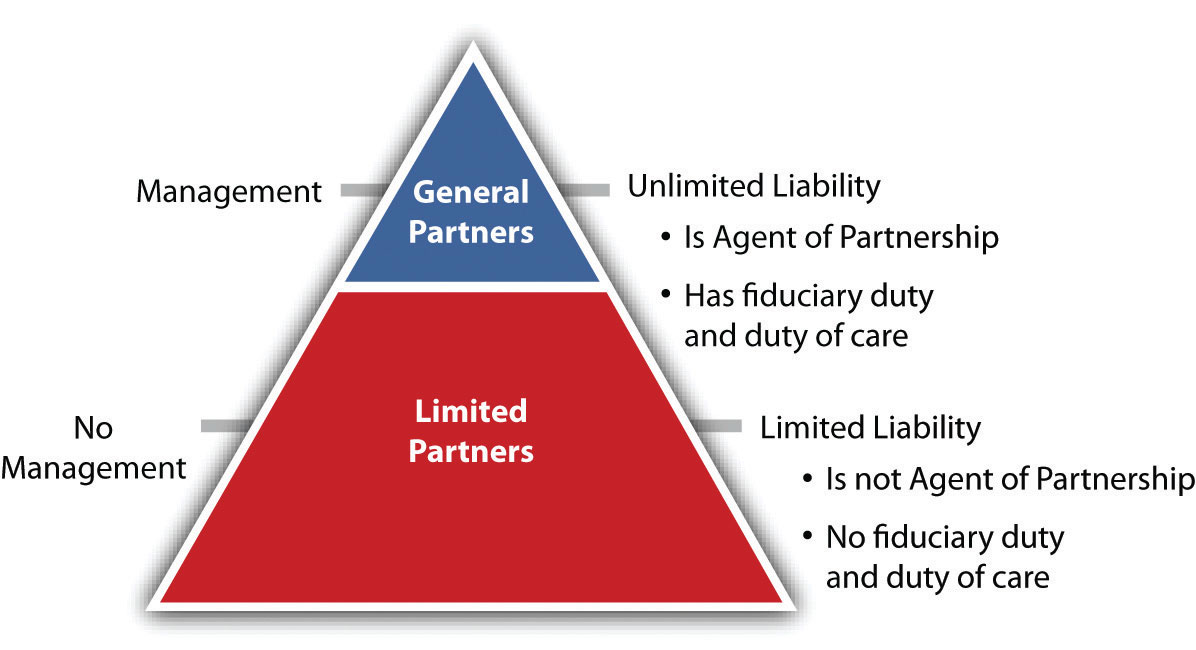

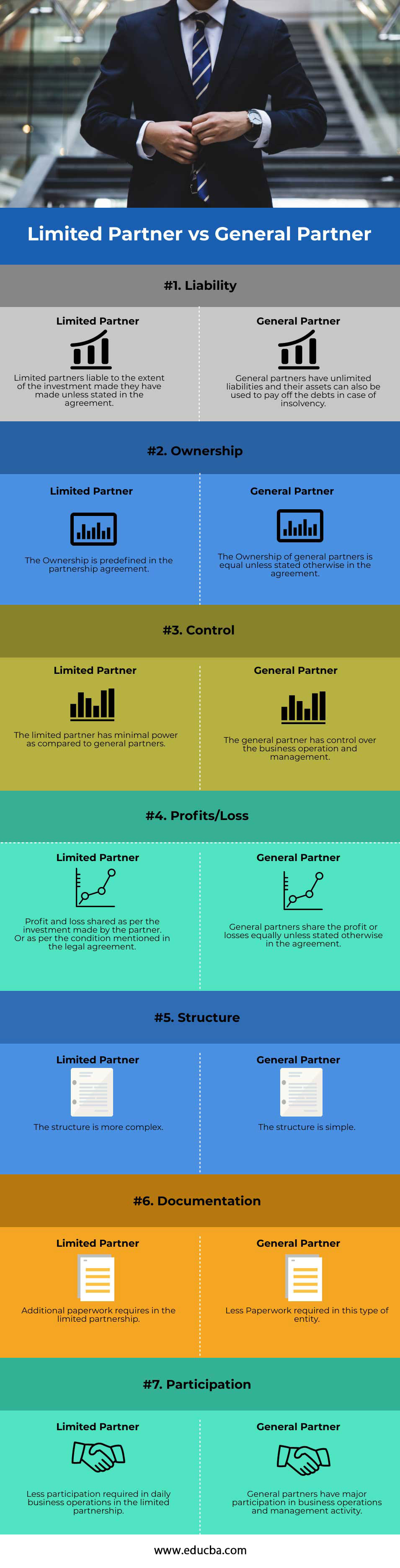

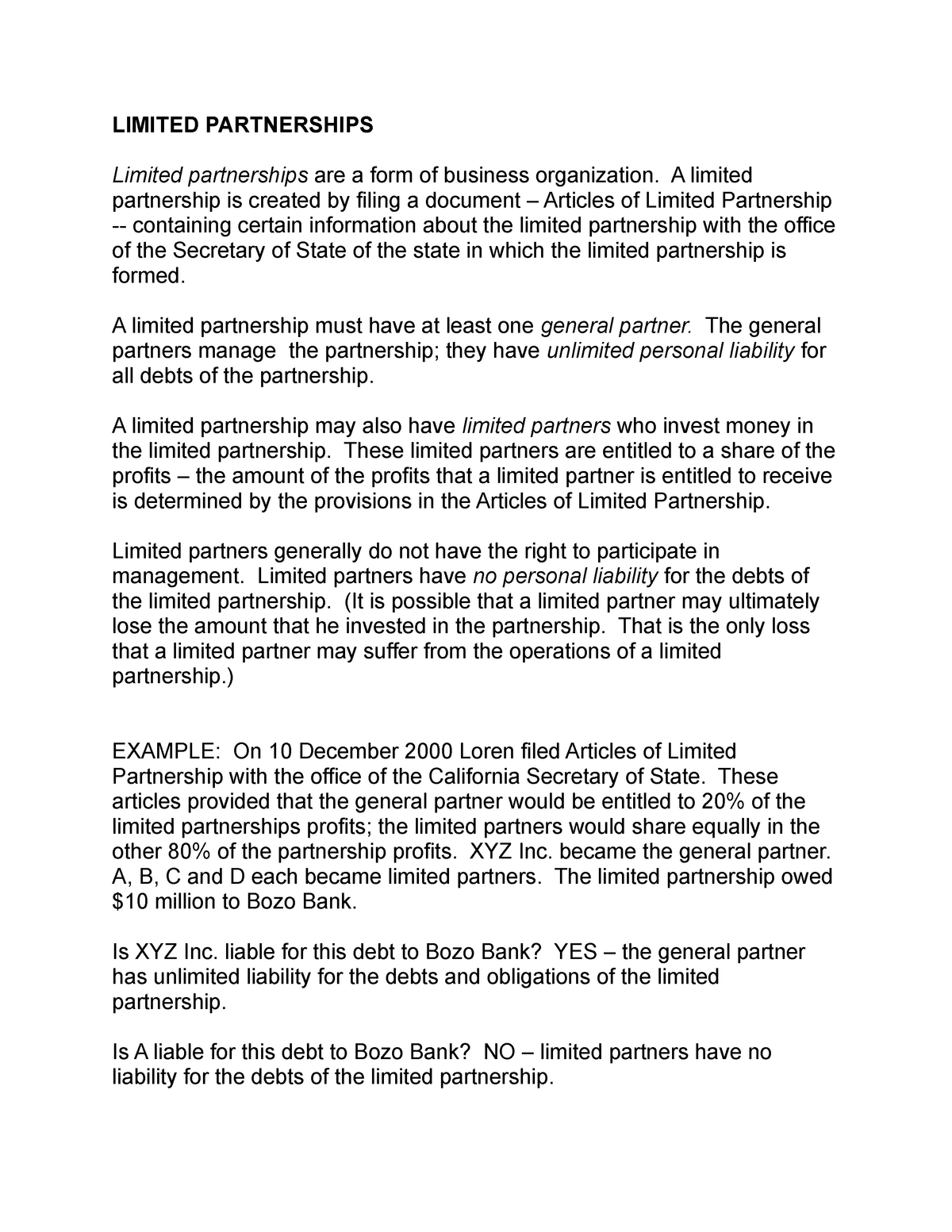

Limited Partnership vs General Partnership • A limited partner is unable to participate in the daily running of the business or in making business decisions, unlike a general partner • The risks to general partners are more as they are liable to the extent of their personal funds and assets if the firm is in debt On the other hand.

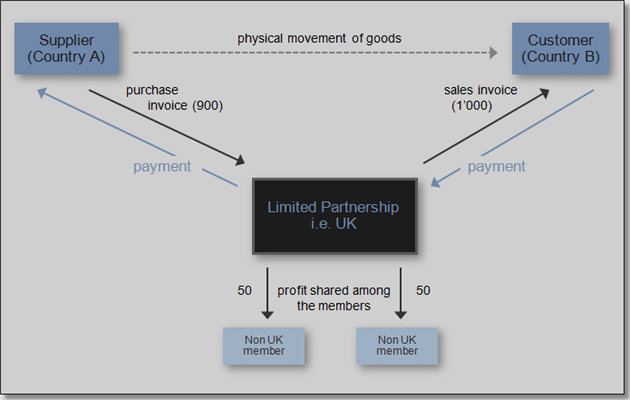

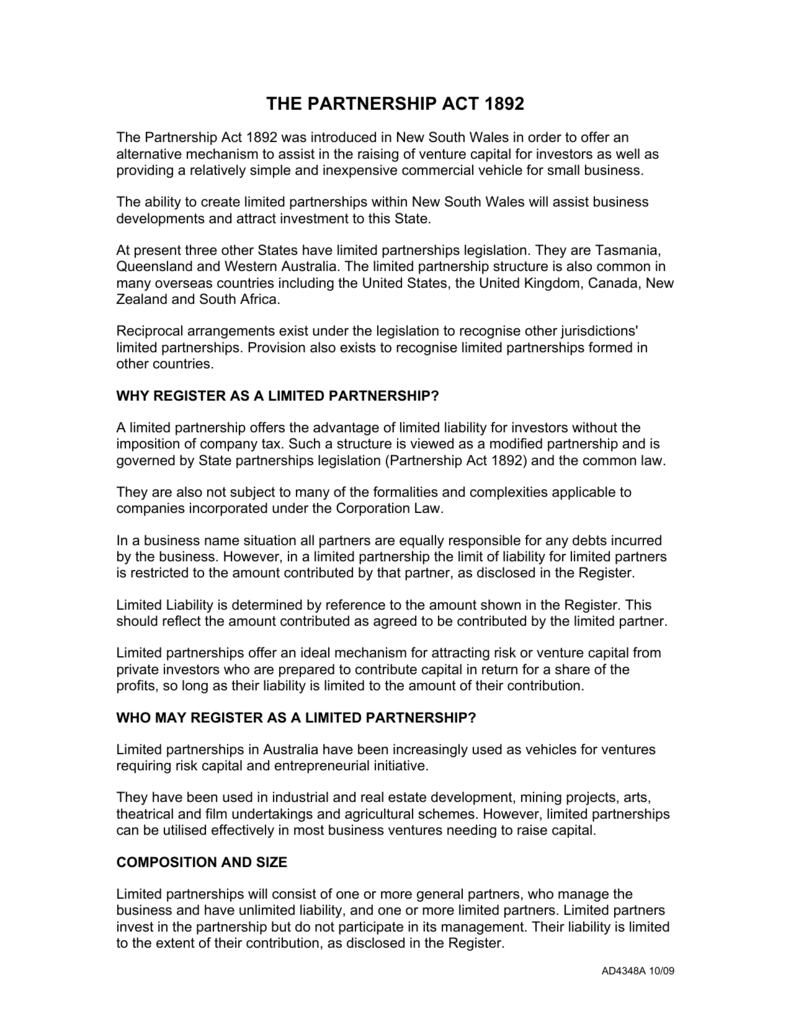

A limited partnership. A limited partnership tax return must be filed annually in order to report the income, deductions, losses, gains, etc, from a limited partnership's operations Limited partnerships do not pay income tax Instead, they will "pass through" any profits or losses to partners Each partner will include their share of a partnership's income or loss. Definition of Limited Liability Limited Partnership in the Definitionsnet dictionary Meaning of Limited Liability Limited Partnership What does Limited Liability Limited Partnership mean?. A partnership is the relationship between two or more people to do trade or business Each person contributes money, property, labor or skill, and shares in the profits and losses of the business Publication 541, Partnerships , has information on how to.

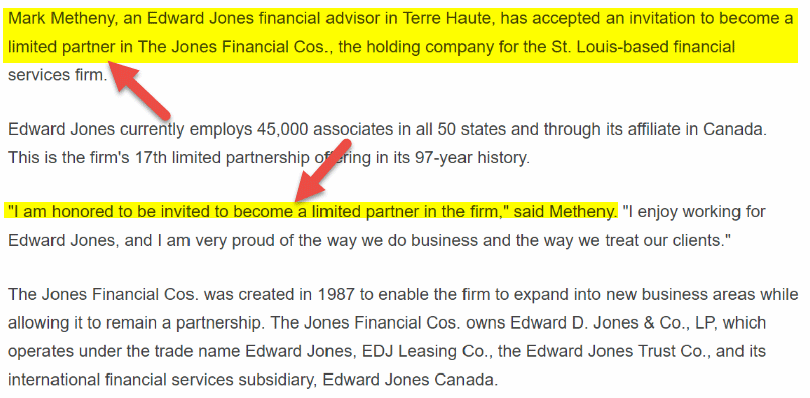

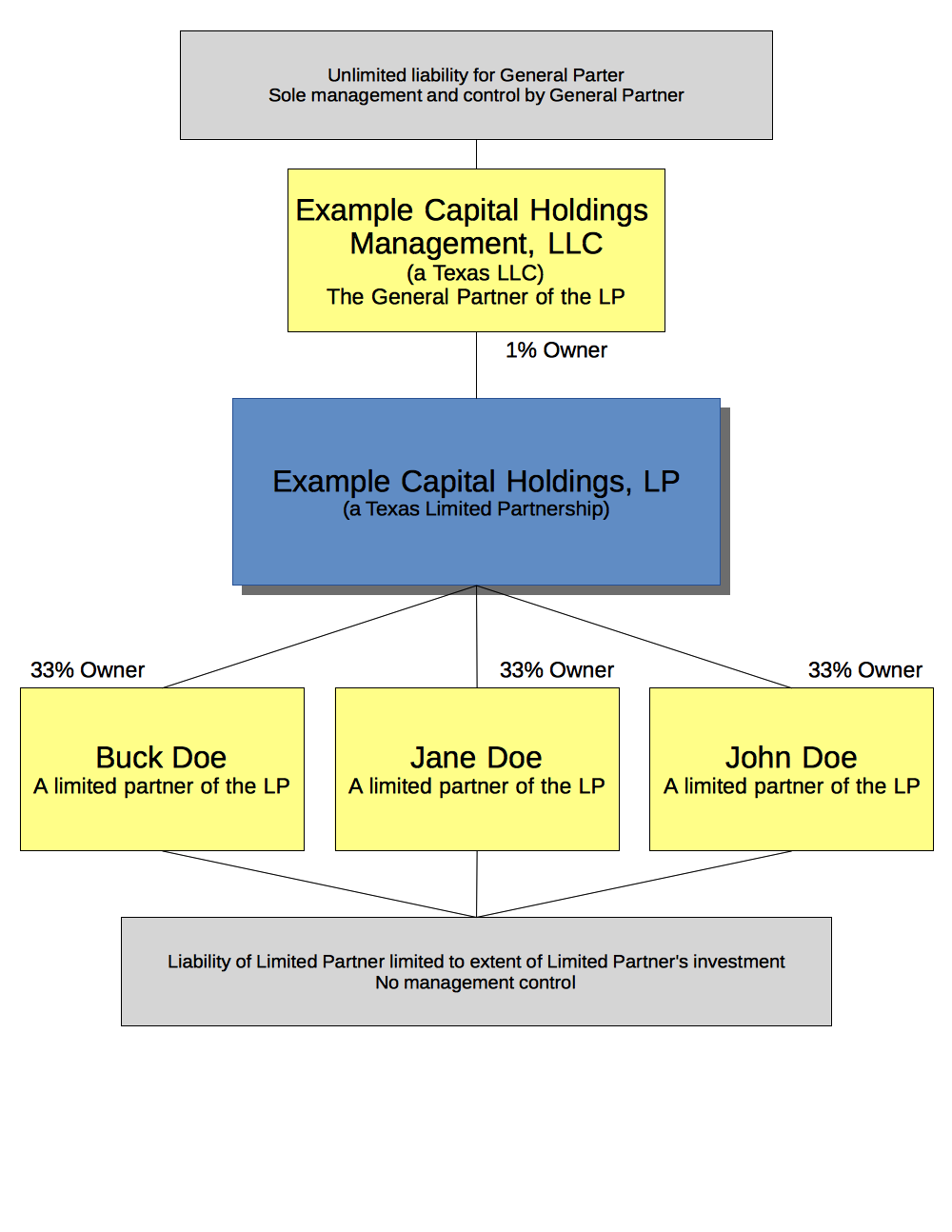

When two or more individuals form an entity to undertake business activities and share profits with at least one person acting as a general partner as against to one limited partner who will have limited liability only up to the capital invested by such partner enjoying the benefits of less stringent tax laws is known as the Limited Partnership. A limited partnership is a partnership formed by two or more persons under the laws of Michigan and having one or more general partners and one or more limited partners The general partners are liable for all the debts and obligations of the firm, while limited partners are responsible only for the. Limited partnership shares are considered securities The limited partnership interest that exist are considered to be securities This means the shares of a limited partnership can be sold to any third party in other to raise capital that has an equity percentage This removes the requirement for a company to go public in order to sell shares.

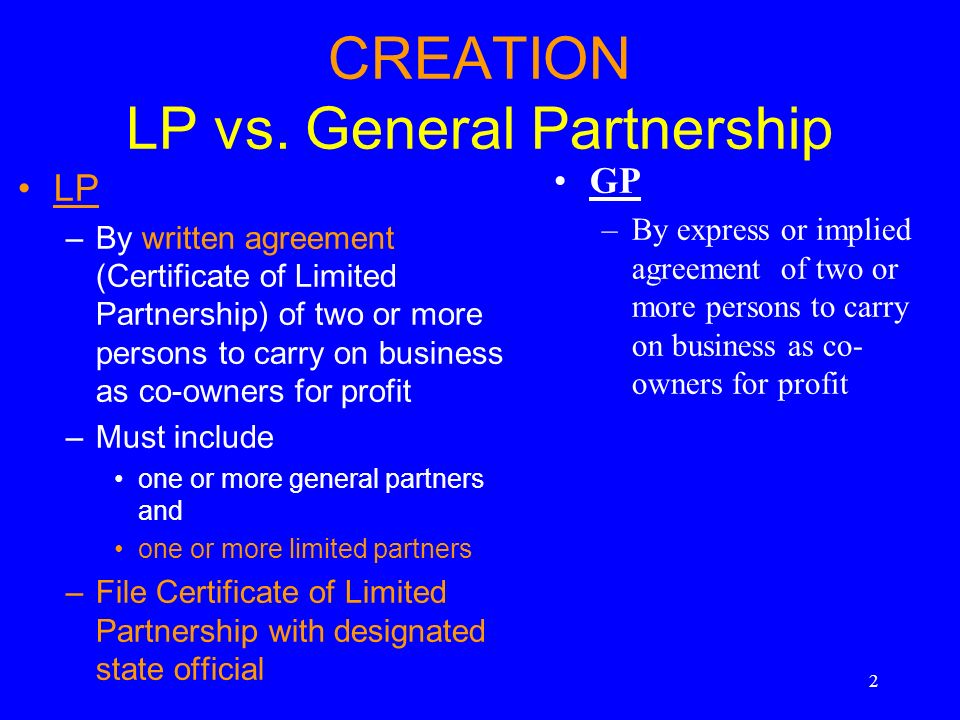

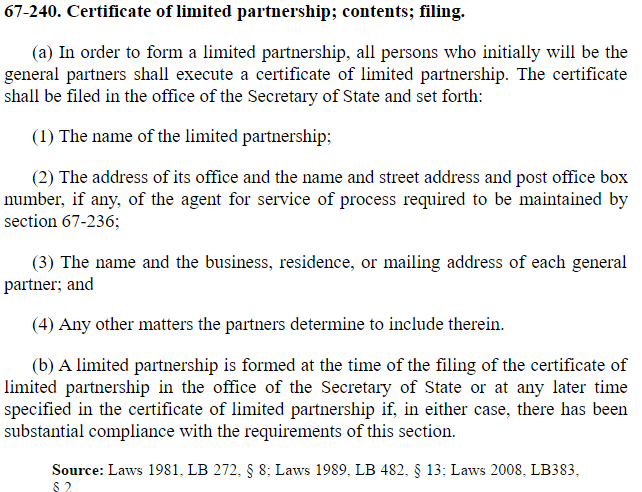

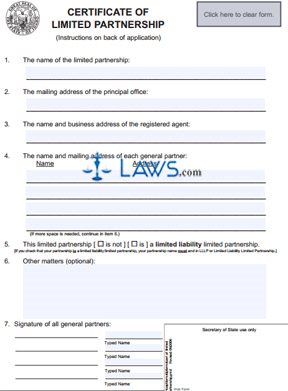

The limited partnership is formed when the certificate of limited partnership is filed Defective Formation occurs when the certificate of partnership 1 is not filed properly 2 contains errors or 3 violates some other statutory requirements Defective formation can result in personal financial liability extending to the limited partnership as. Disadvantages of Limited Partnership In a Limited Partnership, the general partner bears the burden of running the business and is directly liable for the obligations and debts of the company As a separate legal entity, there is a certain amount of. A limited partnership (LP) is where two or more people own a business, but there are two classes of partners general partners (who own and operate the business), and limited partners (who invest their money or property in the business, do not have the right to make decisions regarding the operation of the business, and do not have personal liability for business debts).

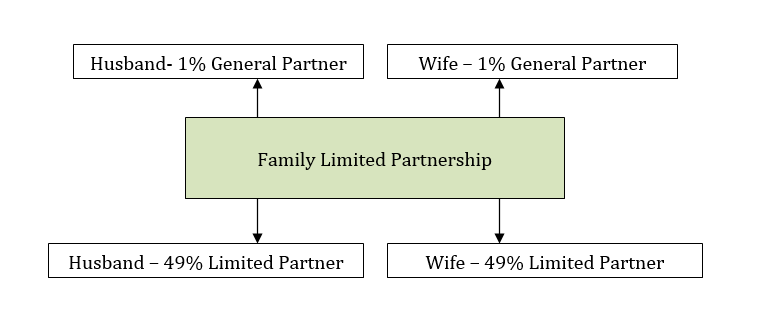

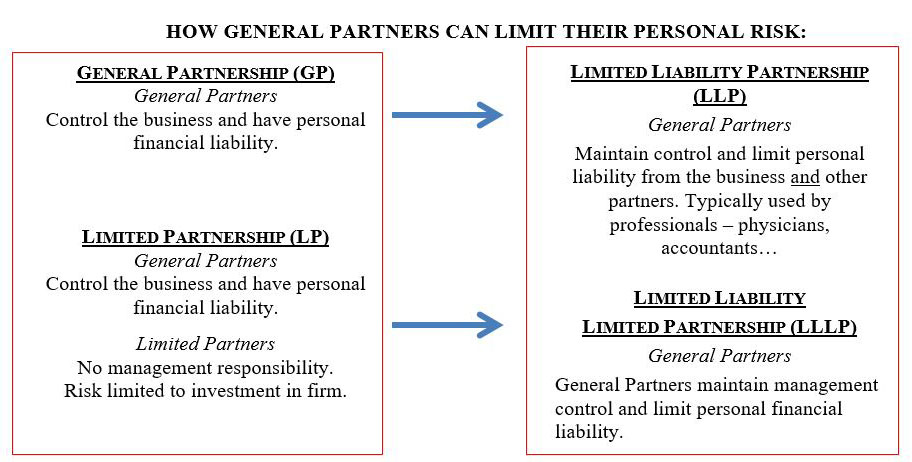

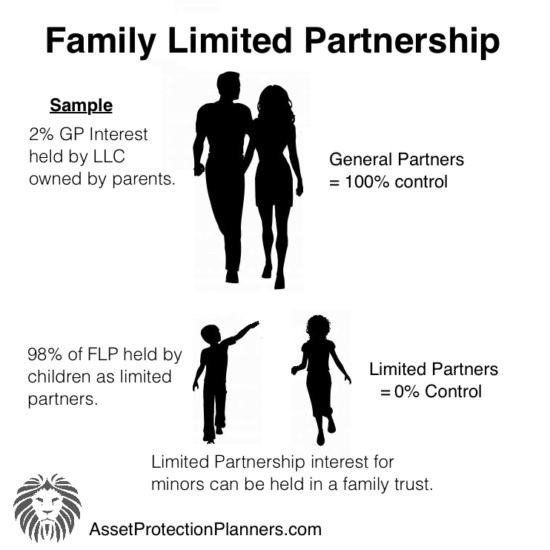

Key Takeaways Limited liability partnerships (LLPs) allow for a partnership structure where each partner's liabilities is limited to Having business partners means spreading the risk, leveraging individual skills and expertise, and establishing a Limited liability means that if the partnership. A great technique for lowering estate taxes and gift taxes is to form a family limited partnership, consolidate your assets within it, and then give part of the partnership away to your heirs each year Unsurprisingly, this particular strategy is frequently used by successful and wealthy families. A partnership is one of the ways you can set up a business It involves two or more persons who wish to start a business together as partners with a common view of profit Forming a limited.

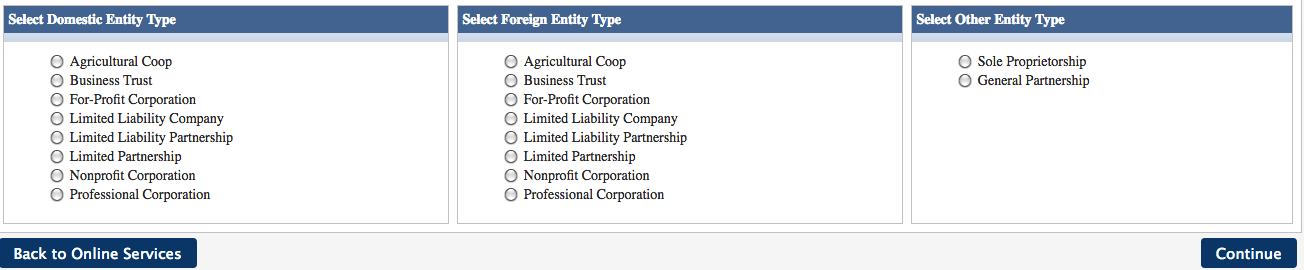

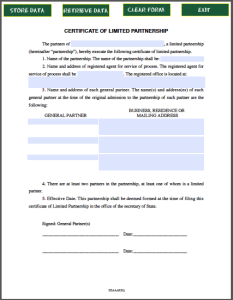

Limited Partnership Disadvantages One potential disadvantage of a limited partnership is that the limited partners have to avoid taking part in daytoday management of the company Otherwise, it’s possible that creditors could successfully argue that they should be held personally liable for the company’s debts. Your Filing Options File online with a credit card OR Complete the fillable PDF form using your computer Print and sign it Mail it to the Division of Corporations with the required payment OR Print the PDF form Complete it using blue or black ink. Limited partnership n a special type of partnership which is very common when people need funding for a business, or when they are putting together an investment in a real estate development A limited partnership requires a written agreement between the business management, who is (are) general partner or partners, and all of the limited partners.

Limited partnerships, by definition, are also more complicated to set up than general partnerships, which form automatically when two partners go into business together To form a limited. LLC Filing as a Corporation or Partnership A Limited Liability Company (LLC) is an entity created by state statute Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner’s tax return (a disregarded entity). A limited partnership (LP) is much like a general partnership, but with a few significant differences Management of a limited partnership rests with the "general partner," who also bears unlimited liability for the company's debt and obligations.

Limited Partnership (LP) Understanding Limited Partnerships Generally, a partnership is a business owned by two or more individuals There are Types of Partnerships An investment partnership is a type of business formation It’s a partnership that’s generally Special Considerations for a. The limited partnership was designed to allow limited partners to invest in the business, but not have the drawback of personal liability However, personal liability still remains for the general partners Advantages of a Limited Partnership Compared to a general partnership or sole proprietorship. A limited liability company that is a theatrical production company is exempt from the publication requirements provided the words "limited liability company" appear in its name Also, a limited partnership that is a theatrical production company is exempt from the publication requirements provided the words "limited partnership" appear in its.

Family limited partnership vs trust A trust is a vehicle set up to hold property for the benefit of the trust's beneficiaries An FLP, however, is a business from which family members profit according to their proportion of general partnership shares and limited partnership shares Family limited partnership vs LLC. A limited partnership makes it easy for friends and family to pool money for major investments, such as starting a restaurant, building an apartment complex, or acquiring an existing company This means economies of scale, access to better lawyers, accountants, bank services, and more Managed well, this can lead to higher returns and more. Foreign Limited Partnership Forms;.

Limited Partnership or LP A Limited Partnership (LP) is comprised of at least one General Partner and at least one Limited Partner This is a business vehicle introduced by ACRA in 09 Pros and Cons of Limited Partnership A corporate body can act as a Limited Partner or General Partner. Family limited partnership vs trust A trust is a vehicle set up to hold property for the benefit of the trust's beneficiaries An FLP, however, is a business from which family members profit according to their proportion of general partnership shares and limited partnership shares Family limited partnership vs LLC. Advantages of Limited Partnership Tax benefits As with a general partnership, the profits and losses in a limited partnership flow through the business Liability limits A limited partner’s liability for the partnership’s debt is limited to the amount of money or property The general partners.

A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilitiesIt therefore can exhibit elements of partnerships and corporationsIn an LLP, each partner is not responsible or liable for another partner's misconduct or negligence This is an important difference from the traditional partnership under the UK. Limited Partnerships are typically formed by individuals or corporations who want to maintain 100% of the control of an asset or project while including investors or heirs on the income from the Limited Partnership Limited Partnerships do not have stock or stockholders Each Limited Partner has a specifically stated percentage of interest in. Limited Partnership vs General Partnership • A limited partner is unable to participate in the daily running of the business or in making business decisions, unlike a general partner • The risks to general partners are more as they are liable to the extent of their personal funds and assets if the firm is in debt On the other hand.

To create a Florida limited partnership OR correct your rejected online filing Review the instructions for filing the Certificate of Limited Partnership for a Florida Limited Partnership Gather all information required to complete the form Have a valid form of payment File or Correct a Certificate of Limited Partnership. Information and translations of Limited Liability Limited Partnership in the most comprehensive dictionary definitions resource on the web. General partners can apply for the limited partnership to act as an authorised contractual scheme (ACS) In an ACS money or property (‘assets’) are pooled and managed on behalf of the partners.

Limited Partnerships are a separate legal entity that can own property, sue, and be sued;. A limited partnership is a partnership formed by two or more persons under the laws of Michigan and having one or more general partners and one or more limited partners The general partners are liable for all the debts and obligations of the firm, while limited partners are responsible only for the. A limited partnership interest in FLP assets offers very restrictive terms, especially in comparison to the general partnership interest A limited partner interest does not have the ability to transfer partnership interest to another person of the limited partner’s choosing A partnership interest in FLP assets also doesn’t allow decision.

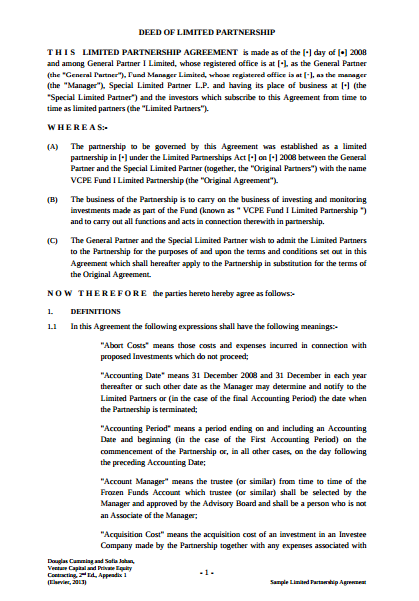

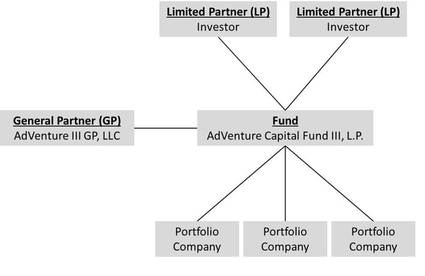

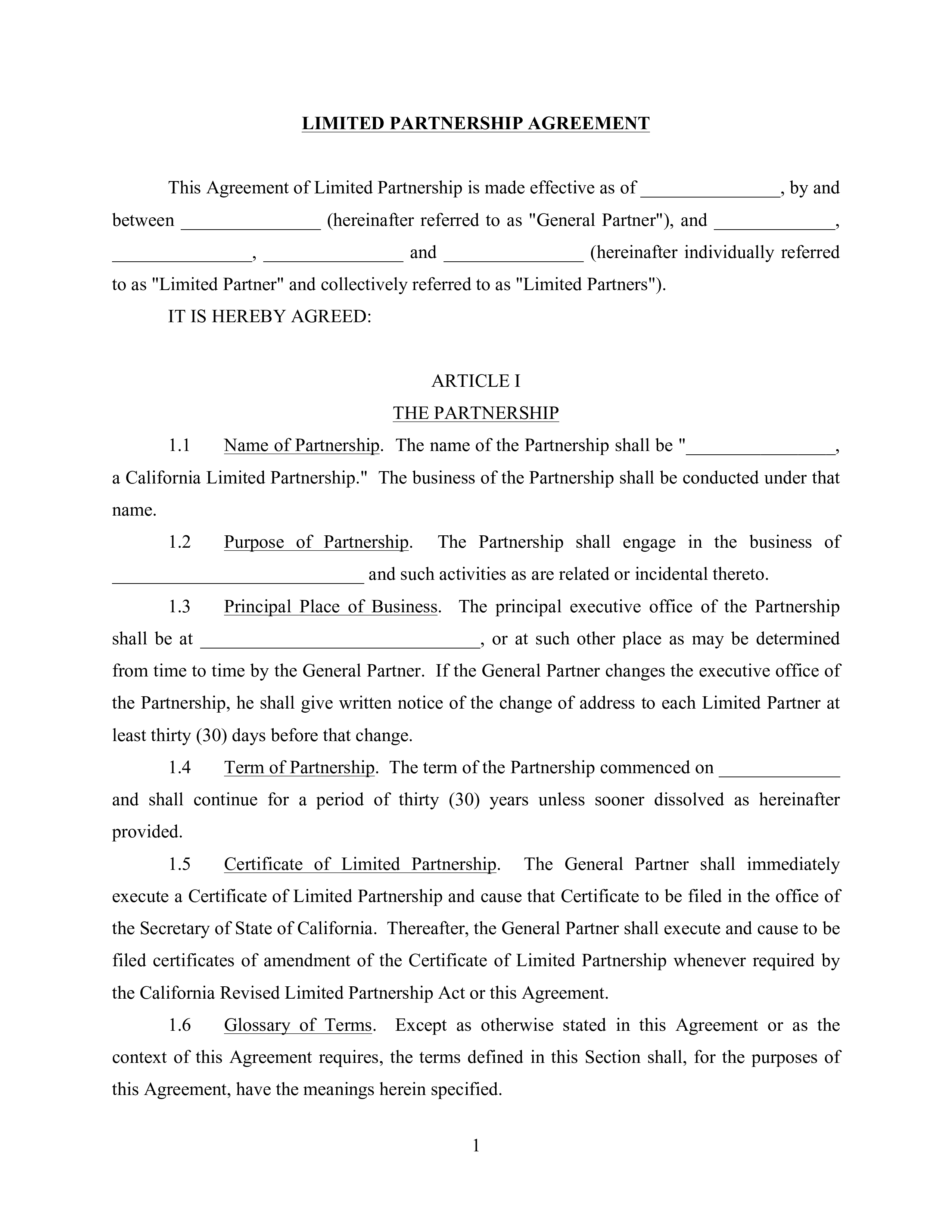

An English limited partnership must be formed between two or more persons and must carry on a business in common with a view of profit Unlike a general partnership , a limited partnership has two categories of partner one or more general partner who manage the business of the partnership and one or more limited partners who do not participate. The limited partnership agreement is the governing document for venture capital funds Learn how limited partnerships work and if your business should be one. A limited partnership interest in FLP assets offers very restrictive terms, especially in comparison to the general partnership interest A limited partner interest does not have the ability to transfer partnership interest to another person of the limited partner’s choosing A partnership interest in FLP assets also doesn’t allow decision.

A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilitiesIt therefore can exhibit elements of partnerships and corporationsIn an LLP, each partner is not responsible or liable for another partner's misconduct or negligence This is an important difference from the traditional partnership under the UK. The definition of a limited partnership is a business with more than one owner, including at least one general partner and at least one limited partner The general partner is in charge, making. Limited partnership shares are considered securities The limited partnership interest that exist are considered to be securities This means the shares of a limited partnership can be sold to any third party in other to raise capital that has an equity percentage This removes the requirement for a company to go public in order to sell shares.

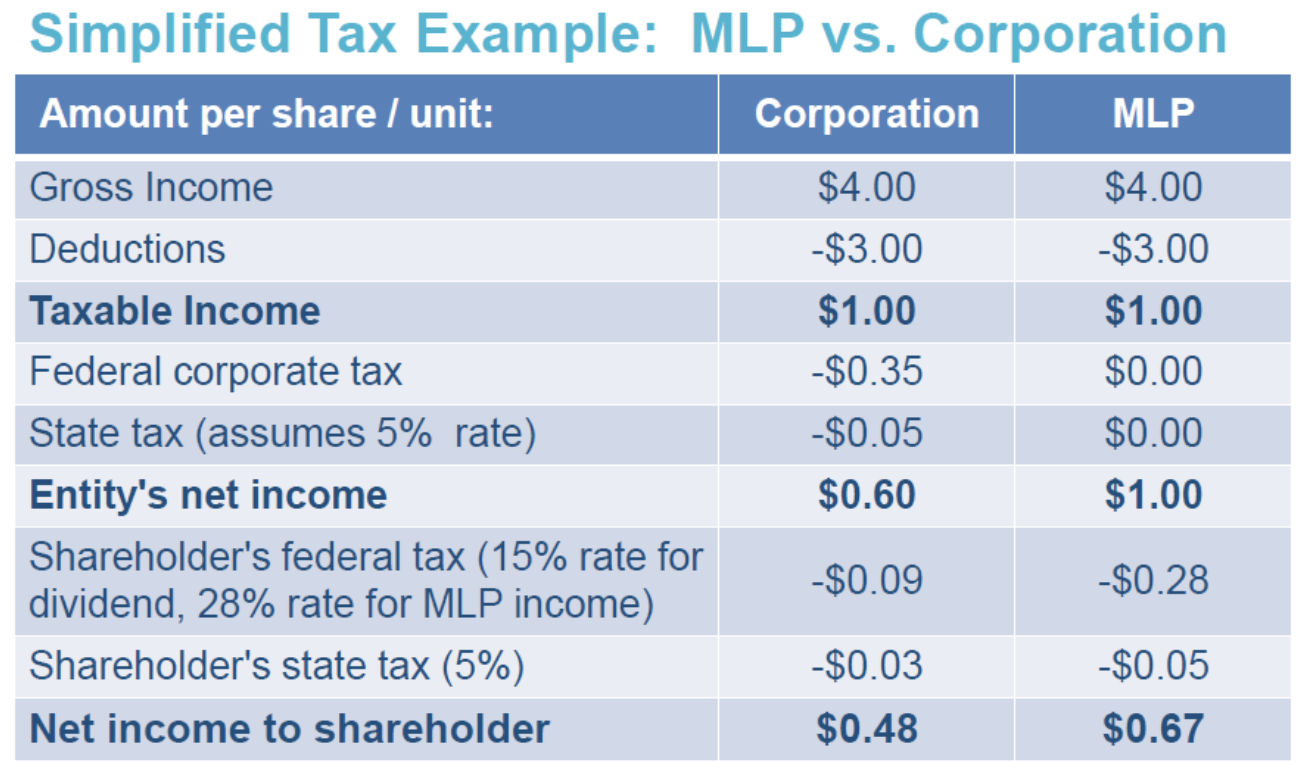

Money › Investment Funds › Limited Partnerships The Tax Advantages of Limited Partnerships 0108 The main tax advantage of a limited partnership is that it is a flowthrough entity — all profits and losses flow directly to the individual limited partners The business itself pays no taxes on its income. A limited partnership is a form of general partnership, which is one of three ways of organizing a business in Canada The other two are sole proprietorship and incorporationEach of these has its own operational, accounting, tax and legal requirements. The limited partners (most LPs have more than one limited partner) contribute financially to the business (for example, a limited partner might invest $100,000 in a real estate partnership) but have minimal control over business decisions or operations, and normally cannot bind the partnership to business deals.

A limited partnership (LP) is a type of business that's owned by two types of partners general partners and limited partners The general partners in an LP make business decisions and take on full liability for the company. A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilitiesIt therefore can exhibit elements of partnerships and corporationsIn an LLP, each partner is not responsible or liable for another partner's misconduct or negligence This is an important difference from the traditional partnership under the UK. Features of Limited Partnerships include a list of activities that the limited partners can be involved in while not participating in the management of the an indefinite lifespan if desired separate legal personality tax treatment for Limited Partnerships.

The limited partnership is formed when the certificate of limited partnership is filed Defective Formation occurs when the certificate of partnership 1 is not filed properly 2 contains errors or 3 violates some other statutory requirements Defective formation can result in personal financial liability extending to the limited partnership as. What is a Limited Partnership?. Limited Partnership A Limited Partnership is similar to a General Partnership in almost every way, except that it is slightly more complex because it offers certain enhancements, including a framework that distinguishes the varying degrees of liability between what is known as a General Partner and a Limited Partner.

A limited partnership is composed of one or more general, and one or more limited partners The general partners have management powers and are responsible for all partnership obligations The defining characteristics of a limited partnership are that limited partners Can invest capital in a business of the limited partnership.

10 Limited Partnership Agreement Templates Pdf Word Free Premium Templates

Why Do You Still Operate Your Business Under A Limited Partnership Estate Planning Probate Attorneys

How General And Limited Partnerships Work Introduction To Legal Structures Youtube

Is Income From A Limited Partnership Held In An Ira Taxable

Chapter Four Limited Partnerships Business Entity Created In Accord With State Statutes That Provides Limited Liability To Some Of Its Members Called Ppt Download

Limited Partnership Agreement Template By Business In A Box

How To Start A Partnership Lp Llp In Indiana In Secretary Of State Start Your Small Business Today

How To Pay A Limited Partner Of Limited Partnership How To Advice For Your Side Hustle Or Small Business

Limited Partnership Definition Harvard Business Services Inc

Limited Partnership Example Advantages Vs General Partnership

Limited Liability Limited Partnership Lllp Incorp Services

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/BusinessPartners-ed07ea2c3c6b4699a539a2ab678865a7.jpg)

Limited Partnership What Is It

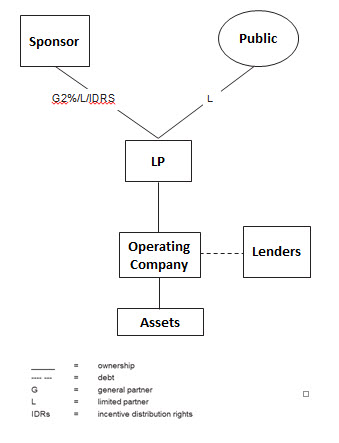

Master Limited Partnership Overview Features Advantages

The Family Limited Partnership The What The Why And The How Sta Wealth Management

Death Of A General Partner Or How Not To Plan For Succession In A Limited Partnership New York Business Divorce

What Is A Limited Partnership The Efficient Solopreneur

Master Limited Partnerships Fundamentals And Related Structuring And Formation Considerations Corporate Commercial Law United States

What Is A Limited Partnership Definition Advantages Disadvantages Business Law Class Video Study Com

Limited Partnerships Legal Entity Management Articles

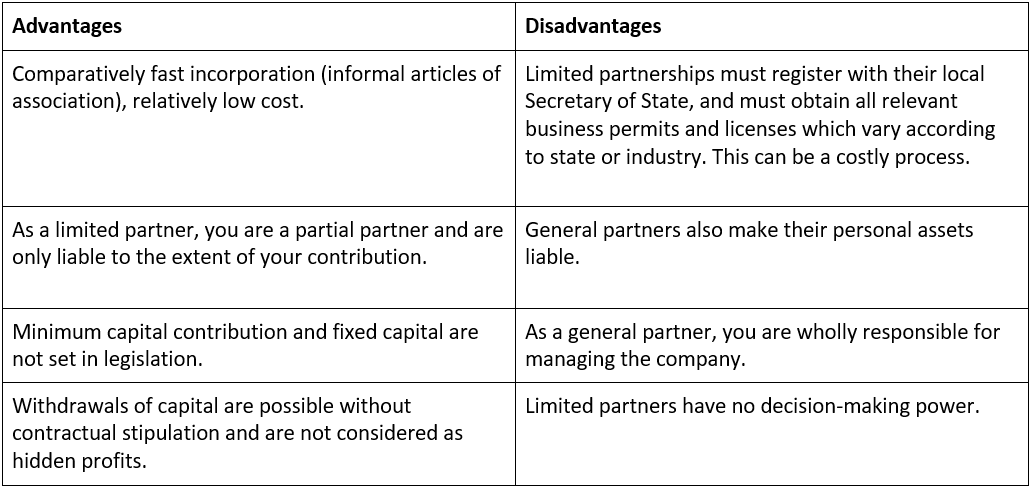

Limited Partnerships A Brief Explanation Ionos

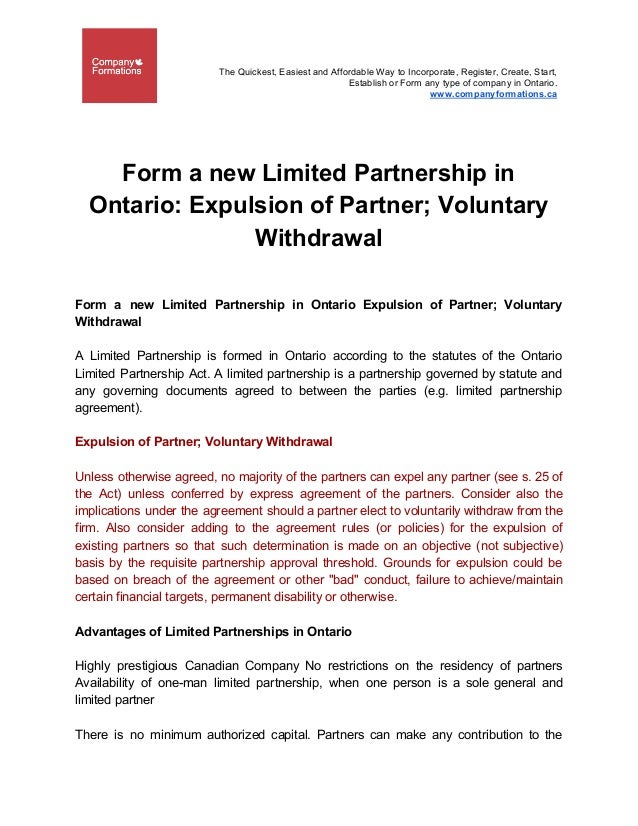

Form A New Limited Partnership In Ontario Expulsion Of Partner Volun

10 Limited Partnership Agreement Templates Pdf Word Free Premium Templates

Limited Partnership And Limited Liability Partnership Powerpoint Guide Graphics Presentation Background For Powerpoint Ppt Designs Slide Designs

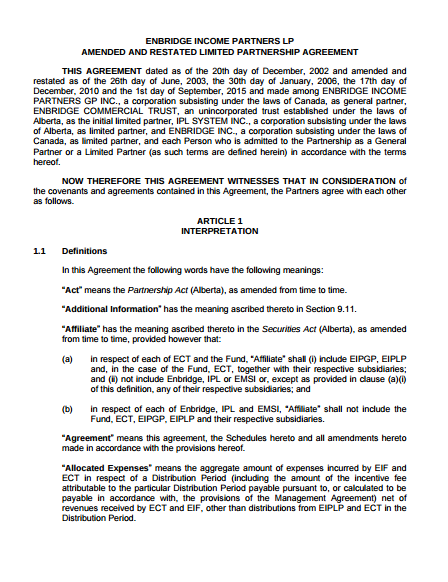

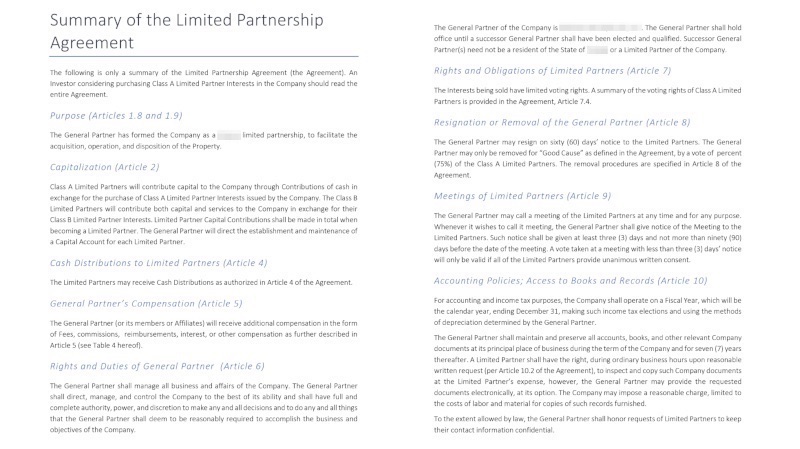

Mariemont Capital Limited Partnership Agreement By Matt Wyler Issuu

Limited Partnership Structure Ppt Powerpoint Presentation Outline Rules Powerpoint Templates

Limited Partnerships A Brief Explanation Ionos

File Chart Of A Limited Partnership Jpg Wikimedia Commons

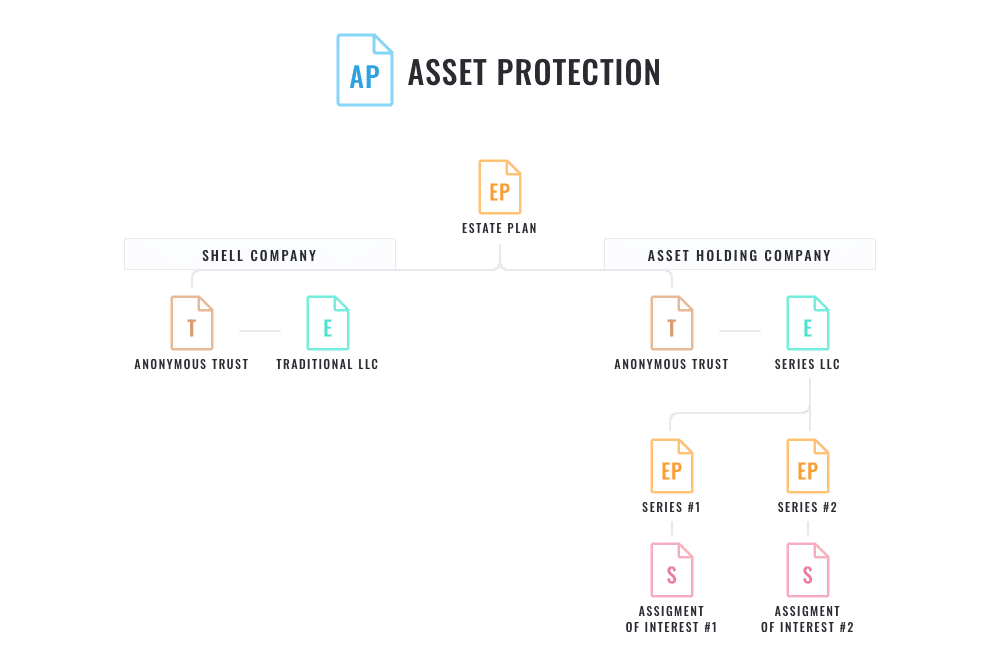

Family Limited Partnership Asset Protection Rjmintz Com Asset Protection Law Center

Limited Partnership Definition What Does Limited Partnership Mean Youtube

4 Types Of Partnership In Business Limited General More

Treatment Of Limited Partnership Lp And Limited Liability Company Llc Interests In Bankruptcy San Jose Business Lawyers Blog January 27 17

Family Limited Partnership

Difference Between General Partner And Limited Partner Difference Between

Using The Manitoba Limited Partnership To Better Protect Limited Partners In Canada Insights Dla Piper Global Law Firm

Family Limited Partnerships Pros And Cons Advisors To The Ultra Affluent Groco

What Are The Characteristics Of A Limited Partnership Or Lp Meg International Counsel Pc

What Is The Difference Between Limited Partners Lps And General Partners Gps In The Venture Capital Business Quora

Family Limited Partnerships What You Should Know

Limited Partnerships Types Of Business Ownership

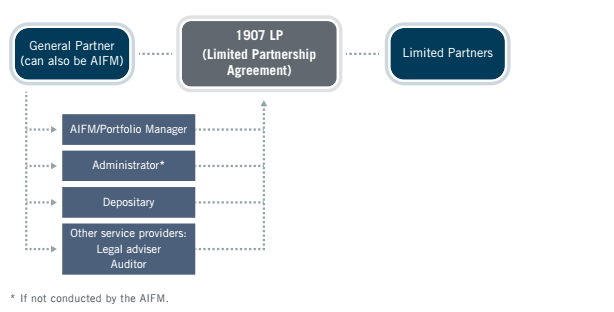

An Introduction To Limited Partnership Funds Who Does What Lcn Legal

Limited Partnership Agreement Template Addictionary

Lp Corner Us Private Equity Fund Structure The Limited Partnership Allen Latta S Thoughts On Private Equity Etc

Which Business Structure Is Best For You Part 9a Limited Partnerships General And Limited Partner Limited Partnership Business Structure Investing Money

Free Limited Partnership Agreement Free To Print Save Download

Limited Partnerships Kkos Lawyers

Limited Partnerships

Limited Partnerships Lp Ppt Download

The Partnership Act 12

This Picture Represents The Major Pros And Cons Of A Limited Partnership As You Can See From The Pictur Harvard Law School Harvard Business School Harvard Law

Limited Liability Partnership Examples Business Report

Opening New Accounts Why So Many Different Types Of Partnerships

The Irish 1907 Limited Partnership Lexology

Oneclass 21 A Limited Partnership Attempts To A B Limit The Number Of Partners Who May Vote At B

Is A Limited Partnership Right For My Business Legalzoom Com

Pros And Cons Of A Limited Partnership By Allan Lloyd Medium

What Is A Limited Liability Partnership Definition Advantages Disadvantages Video Lesson Transcript Study Com

Limited Partnerships Incorp Services

Limited Partner Vs General Partner Top 7 Differences You Should Know

How To Start A Partnership Lp Llp In Nebraska Ne Secretary Of State Start Your Small Business Today

Limited Partnership Certificate Template Free Fillable Pdf Forms

Family Limited Partnerships

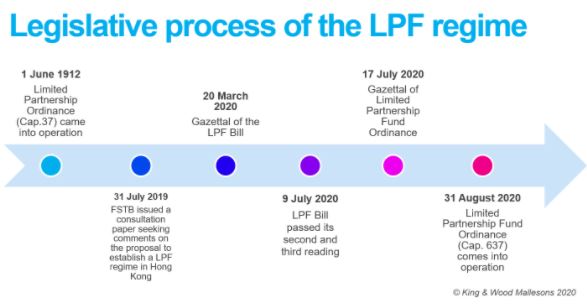

The Wait Is Over Hong Kong Limited Partnership Fund Regime To Roll Out On 31 August Lexology

.jpg?sfvrsn=2)

Llc Vs Partnership Gp Lp And Llp Bizfilings

What Is A Limited Partnership

General Partnership Vs Limited Partnership Harvard Business Services

Limited Partner Vs General Partner Top 7 Differences You Should Know

.jpg?la=en)

Limited Partnerships And Their Personality Ashurst

Start A Limited Partnership In Switzerland

Limited Partnership For Real Estate Investors Asset Protection For Real Estate Investors Royal Legal Solutions

What Is A Master Limited Partnership Mlp Intelligent Income By Simply Safe Dividends

Free Printable Limited Partnership Agreement Form Generic

A1049incentivepool

What Is A Limited Partnership Type Of Partnership In Business

Kostenloses Limited Partnership Agreement Example

Ppm 3 Ppm Company Formation Your Role As A Limited Partner Boardwalk Wealth

Partnerships Introductory Paragraphs Signature Blocks Signatories Blue Skies Contract Services

Limited Liability Limited Partnership Wikipedia

Limited Partners What Are Your Rights Mercer Capital

Latham Watkins Llp Master Limited Partnerships Generic Content

Partnership Limited Partnership Oldani Entrepreneurial Law P C

Limited Partners Lp Vs General Partners Gp In Private Equity

Limited Partnerships Lecture Notes 8 Studocu

The Advantages Of A Limited Partnership Structure For New Businesses Duncan Craig Llp

Limited Partnership Agreement Pros Cons And Sample Template

Free Form Id 230 Certificate Of Limited Partnership Free Legal Forms Laws Com

Family Limited Partnership What Is One And How It Protects You

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/how-to-form-a-limited-partnership-57ecae195f9b586c352bd903.jpg)

Learn How To Form A Limited Partnership

Solved 14 In A Limited Partnership A There Are Limit Chegg Com

What Is The Difference Between A General And Limited Partnership

Limited Partnership Business Type Advantages And Disadvantages

Limited Partnership Lp Definition